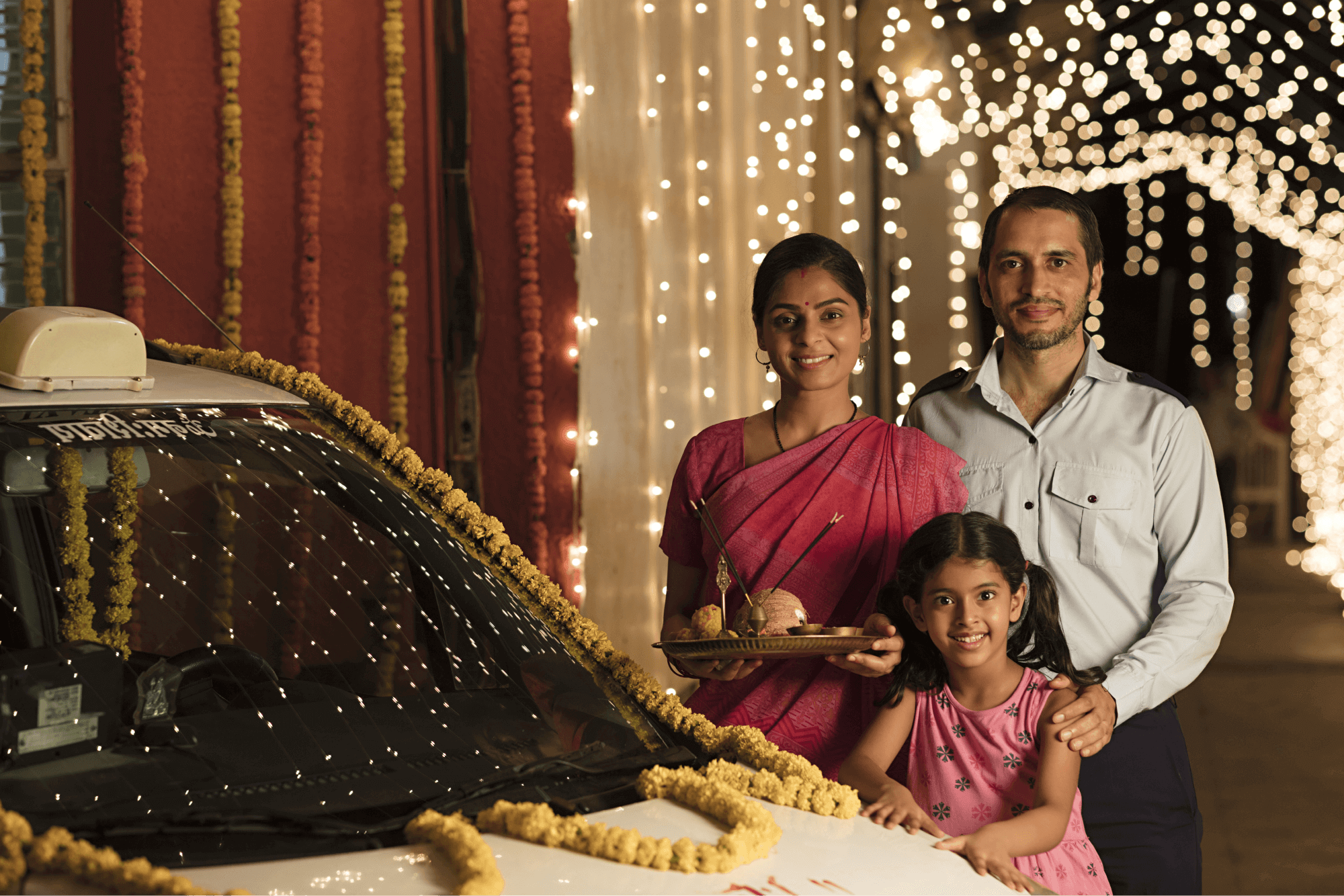

Car Loan

Affordable loans in your dream car

About Car loan

- Buying a new car.

- Purchase a pre-owned car.

A car loan/car finance can be availed individually or jointly with close relatives. Car finance/car loan are secured loans where the car itself is used as a collateral.

Most of the rules and processes that apply to other loans also apply to car loans. Check benefits, features, interest rates and eligibility before applying for a car loan.

.jpg)

Submit your details

Fill your details in our platform

Select your loan offer

Choose from available offers

Complete instant V-KYC online

Verify your identity

Get your loan disbursed

Submit application

Car Loan

Acquire your desired vehicle through car loans provided by us. Secure a loan tailored to your needs and preferences, enabling you to purchase a hatchback, sedan, MUV, SUV, sports car, or luxury vehicle. Our car financing options are accessible to a wide range of individuals, including salaried employees, entrepreneurs, professionals, corporations, NRIs, and PIOs.

Used Car Loan

we are providing a pre-owned car loan and we give maximum upto 95% financing, Low interest rates, minimum documentation, we are giving a quick processing, and higher loan amount. Secure a loan tailored to your needs and preferences, enabling you to purchase a hatchback, sedan, MUV, SUV, sports car, or luxury vehicle

Balance Transfer

facility allows borrowers to transfer their outstanding car loan to a new lender for lower interest rates or better loan terms. However, opt for this facility only when the savings made through the transfer outweighs the cost of the loan transfer.

Refinance

Car loan refinancing is the process of replacing your existing car loan with a new one, usually from a different lender. Refinancing your car loan can help you save money by scoring a lower rate of interest. As a result, you can decrease your monthly payments and free up cash for other financial obligations.

Top-Up

It is offered to existing Car loan borrowers who need additional funds to meet their financial requirements. This loan facility is usually offered to select borrowers having satisfactory loan repayment history and/or have completed a specified number of EMIs.

How to apply Car Loan

Our Car Loan application process is easy and gives you a quick turnaround. The loan application can be made both online and offline which means you can either visit our branch or opt for our quick 4-step process

- Fill the details

- Get Call back

- Document verification & Approval

- Successful disbursed

Lending Partners

.png)

.png)

.png)